SEC Commissioner Calls for ‘Consistent Legal Framework’ for All Asset Classes, Including Crypto – Regulation Bitcoin News

[ad_1]

A commissioner with the U.S. Securities and Exchange Commission (SEC) has called for “a coherent and consistent legal framework that works across all asset classes,” including crypto assets. She warned that the SEC’s current enforcement-centric approach would take 400 years to go through all the crypto tokens that are allegedly securities.

SEC’s Commissioner on Crypto Regulation

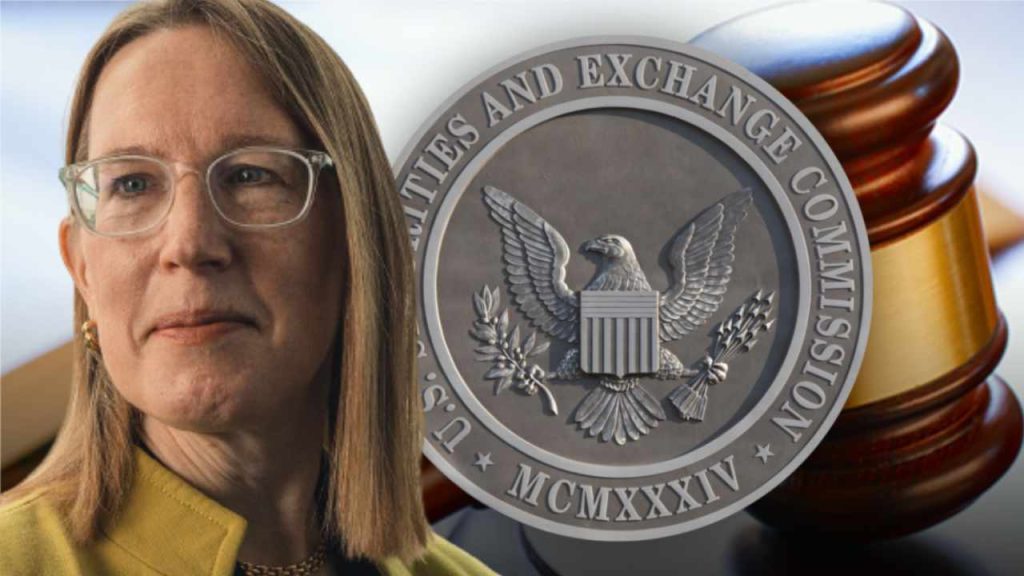

A commissioner with the U.S. Securities and Exchange Commission (SEC), Hester Peirce, talked about crypto regulation in her speech at the “Digital Assets at Duke” conference on Jan. 20.

Noting that the securities regulator has “pursued registration violations in a seemingly random fashion, often years after the original offering,” the commissioner stressed:

We must develop a coherent and consistent legal framework that works across all asset classes. Our imprecise application of the law has created arbitrary and destructive results for crypto projects and purchasers.

“When we insist on applying the securities laws in this manner, secondary purchasers of the token often are left holding a bag of tokens that they cannot trade or use because the SEC requires special handling consistent with the securities laws,” Peirce warned. “Many of these requirements are enforced under a strict liability standard, so clarity is essential.”

The commissioner continued, “Why not set forth a coherent legal framework in a rule?” elaborating:

After all, if we continued with our regulation-by-enforcement approach at our current pace, we would approach 400 years before we got through the tokens that are allegedly securities.

“By contrast, an SEC rule would have universal—albeit not retroactive—coverage as soon as it took effect,” she noted.

Commissioner Peirce further explained: “A rational framework should facilitate the compliance of good faith crypto actors with our securities laws, which would free the SEC to focus more of its resources on the bad faith actors.”

However, she cautioned:

Crypto regulation is not easy to do well. If crypto institutions are treated like regular depository institutions, requiring heavy layers of capital and lots of legal staffing, crypto innovation is likely to dwindle.

This was not the first time Commissioner Peirce has raised concerns about the way the SEC has been regulating the crypto sector. She has repeatedly criticized the securities watchdog for taking an enforcement-centric approach to regulating the crypto space. She also believes that the regulator should have already approved a spot bitcoin exchange-traded fund (ETF). In May last year, she warned that the SEC has dropped the ball on crypto oversight, stating: “We’re not allowing innovation to develop and experimentation to happen in a healthy way, and there are long-term consequences of that failure.”

Commissioner Peirce is not the only one who is concerned about the SEC’s enforcement-centric approach. U.S. Congressman Tom Emmer (R-MN), for example, has repeatedly criticized SEC Chairman Gary Gensler. “Under Chair Gensler, the SEC has become a power-hungry regulator,” the lawmaker said in July last year.

Do you agree with SEC Commissioner Hester Peirce? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link