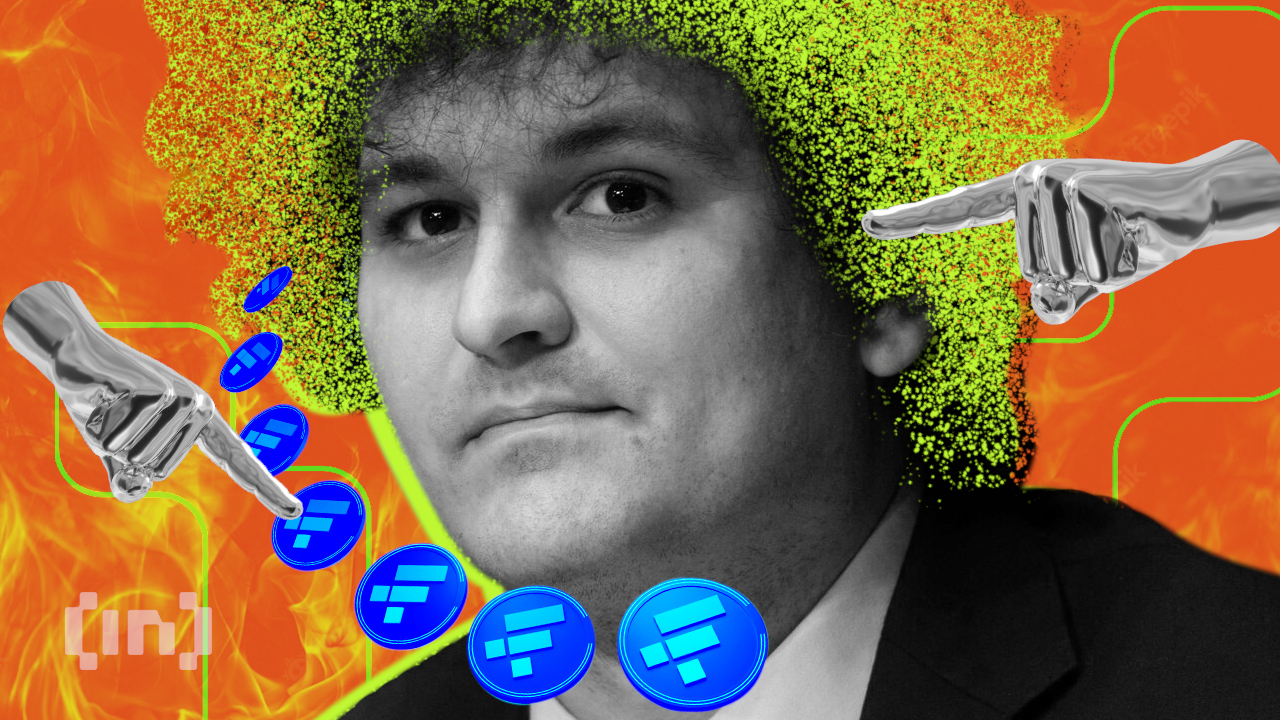

Sam Bankman-Fried Still NYT Darling Despite Theft of the Century

[ad_1]

The New York Times has come under fire once again for presenting FTX co-founder Sam Bankman-Fried in a positive light in its latest piece.

The article by Rob Copeland highlights how former FTX CEO Sam Bankman-Fried is not a villain in the Bahamas. Earlier this month, the former chief was apprehended in the Bahamas for fraud and other criminal counts.

Additionally, the piece contains testimonies from Bahamians who describe Sam Bankman-Fried as having “a good heart.” The article also highlights how the white-collar nature of his actions is not equivalent to the violence that permeates some parts of the island.

Industry Puts Spotlight on NYT and Sam-Bankman-Fried Again

Genevieve Roch-Decter, CEO of financial media company GRIT, took to Twitter to put the spotlight on the publication.

Patrick Lowry, chief of Cryptology Asset Group, called it a “paid shill” on NYT’s part to carry the article. In November, the publication also received flak for carrying an interview presenting SBF’s explanation of the collapse. The industry dismissed it as a “puff piece.”

According to Jesse Powell, the former boss of Kraken, NYT has been downplaying the collapse. He previously argued that the victims would not have been so trusting with their money if it weren’t for the media’s support and the constant puff stories.

Kraken’s Juthica Chou also pointed out the publication’s differential treatment involving pieces on Powell and Coinbase’s Brian Armstrong.

FTX Political Backing in Question

This time as well, other Twitter users also expressed their concern that the article might be a touch too lenient toward the disgraced crypto tycoon. The former FTX CEO was reportedly a significant contributor to the financing of the U.S. political parties.

According to Axios, Bankman-Fried spent almost $37 million on political campaigns, majorly supporting Democrats during the most recent election cycle. Several politicians backed SBF is also a discussion in the industry.

That said, with FTX’s bankruptcy filing, investors now wait to reclaim their ownership of the funds. At the same time, SBF is now estimated to be worth next to zero while facing legal proceedings. Last week, SBF reportedly obtained a $250 million bond bail using his parents’ property as collateral.

Meanwhile, media reports confirm that former executives from the bankrupt FTX have also turned on SBF. Caroline Ellison and Gary Wang, two senior executives, recently entered guilty pleas to a number of criminal charges. Their testimony also puts the onus on SBF for knowingly orchestrating financial fraud and misusing customer funds.

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.

[ad_2]

Source link