Public Bitcoin Miners Have Liabilities of Over $4B

[ad_1]

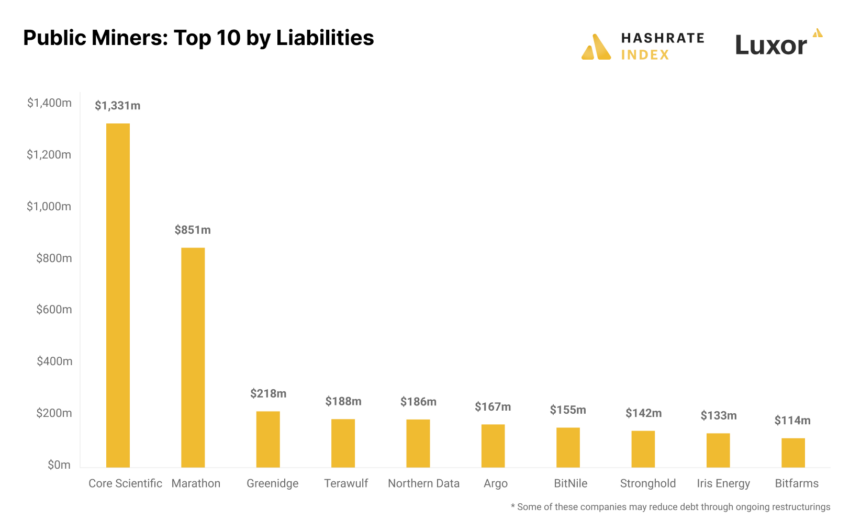

Public bitcoin miners in the US collectively owe over $4 billion, with Core Scientific, Marathon, and Greenridge Generation being the biggest debtors, according to data from Hashrate Index.

According to the data, the biggest debtor is Core Scientific, with $1.3 billion in liabilities as of Sept. 30. The miner recently filed for bankruptcy. Its debt load requires the payment of tens of millions monthly to service its debt.

This meant that even though the company had a positive cash flow, it could not meet its debt obligations due to the drop in bitcoin prices. Hence, its decision to file for bankruptcy.

Public Bitcoin Miners Were Responsible For 15% of BTC Mining

Notably, Core Scientific is the public miner with the highest hashrate. The public miners were responsible for 15% of all Bitcoin mining in 2022, and Core Scientific is responsible for a quarter of this. This shows how rough the year has been for miners.

Meanwhile, Marathon is the second biggest debtor, with $851 million in debt. Fortunately, most of its debts are in convertible notes, which do not require monthly service payments. This put it in a better position and is not at risk of bankruptcy.

However, the third biggest debtor Greenridge Generation is not so lucky. It has a debt of $218 million and now teeters on the brink of bankruptcy. It is trying to complete a debt restructuring deal that will reduce its debt but will also see it transfer most of its hashrate to NYDIG.

Other public miners, including Terawulf, Norther Data, Argo, BitNile, Stronghold, Iris Energy, and Bitfarms, complete the top ten. All of them have debts above $100 million.

Most Miners Have High Debt-to-equity Ratio.

The biggest problem for public miners is not their debt but their debt-to-equity ratio. Generally, a debt-to-equity ratio of 2 or more would be considered risky. Given the volatile nature of the crypto market, it ought to be lower.

But most public miners have a far higher debt-to-equity ratio. Core Scientific has a ratio of 26.7, Greenridge 18.0, Stronghold 11.1, Argo 8.7, and Cathedra 5.3. More than half of the 25 public bitcoin miners have debt-to-equity of over 2.

Additionally, with the debt of public miners being $4 billion while equity is $2.2 billion, the entire sector has a debt-to-equity ratio of 1.8, which is relatively high. Although many miners are trying to restructure debt, the future still looks gloomy.

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.

[ad_2]

Source link