Multi-Million Dollar Companies Reveal Bitcoin Price Prediction 2024

[ad_1]

Despite recent turbulence in the crypto market, leading financial institutions remain bullish on Bitcoin’s future, as noted in their predictions.

As 2024 begins, these organizations project significant growth for Bitcoin, with price predictions ranging from a moderate increase to $80,000 to a staggering surge beyond $600,000.

Messari: Bitcoin Could Reach Parity with Gold

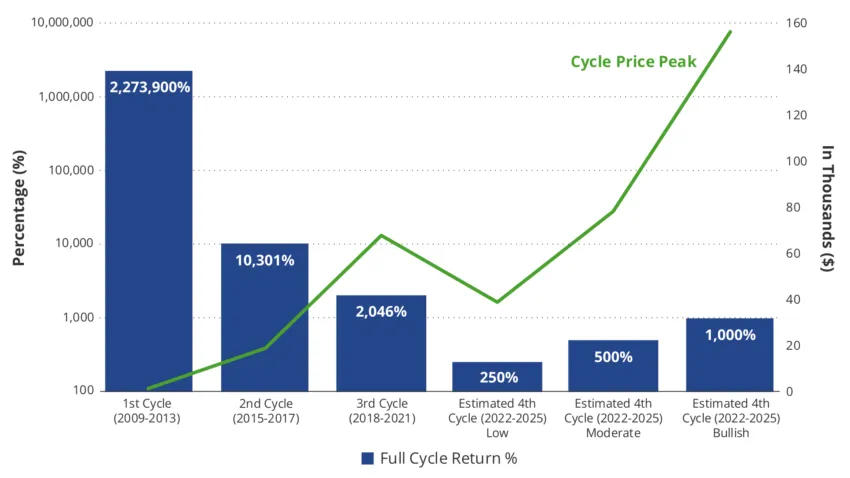

Messari, a notable name in crypto analytics, predicted a Bitcoin value exceeding $600,000. Its analysis underscored Bitcoin’s resilience and dominance in the cryptocurrency market, citing its ability to lead recoveries and overshadow other digital currencies.

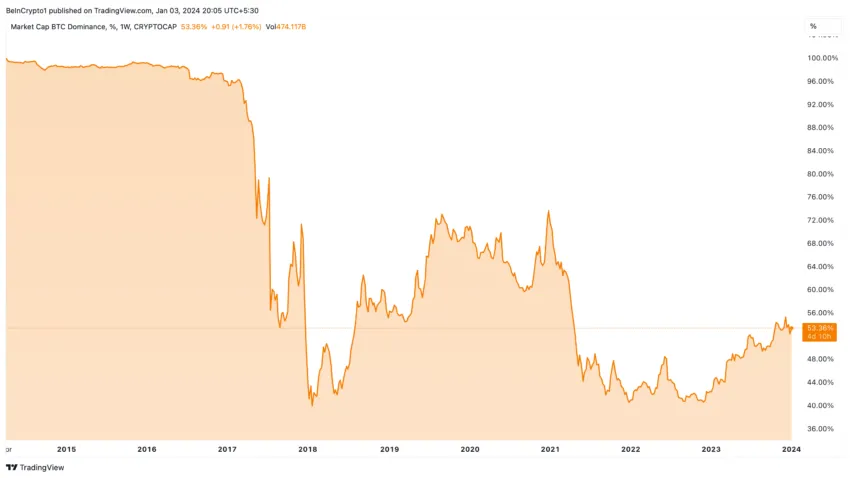

“We’ve recently seen multi-year highs for bitcoin dominance, but still nothing close to the high-water mark we attained at the beginning of the 2017 and 2021 bull runs. Bitcoin dominance shrank from 87% to 37% in 2017. It reclaimed 70% during its consolidation phase and run-up to $40,000 in 2021 before dropping to 38% at the height of the bubble. We just tapped 54%. There’s still room to consolidate,” analysts at Messari argued.

While acknowledging potential challenges, such as regulatory issues in the DeFi sector and the slowdown in NFT activities, Messari’s outlook was rooted in Bitcoin’s historical performance and comparative advantage over other assets.

“We probably won’t see another 100x for Bitcoin, but the asset could easily outperform other established asset classes once again in 2024. Eventual parity with gold would yield a price per BTC of over $600,000,” analysts at Messari concluded.

VanEck: Bitcoin Inflows to Mimic Gold Post-ETF

VanEck, a global investment manager, set its sights on a $275,000 price tag for Bitcoin. Its rationale hinged on the growing demand for “hard money” assets like Bitcoin and gold, especially during economic downturns.

“As debt levels are more concerning at the sovereign than corporate or household levels, we expect more than $2.4 billion will flow into newly approved US spot Bitcoin ETFs in Q1 2024 to keep the Bitcoin price elevated. Notwithstanding the possibility of significant volatility, the Bitcoin price is unlikely to fall below $30,000 in Q1 2024,” analysts at VanEck emphasized.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

VanEck drew parallels between the early success of gold ETFs and the potential for Bitcoin ETFs to attract substantial capital inflows, bolstering the cryptocurrency’s value. The firm also anticipated a significant increase in Bitcoin’s market share from gold, driven by heightened voter awareness of monetary policies and the potential regulatory shifts in the wake of the US Presidential election.

“The GLD ETF launched on November 18, 2004, and it saw inflows of around $1 billion in the first few days of launch, and by the end of Q1 2005, around $2.26 billion was in GLD… If we apply these figures to the Bitcoin spot market, we arrive at inflows of $310 million in the first few days of BTC spot ETF and ~$750 million within a quarter,” analysts at VanEck explained.

ETC Group’s Balanced View: Slightly Above $100,000

ETC Group, another player in the financial system, forecasted Bitcoin to slightly exceed $100,000. Its prediction was based on the anticipated acceleration in Bitcoin’s adoption, fueled by the upcoming Bitcoin Halving in April 2024.

“While some pundits argue that, from a pure theoretical point-of-view, the Bitcoin Halving should already be priced in since it is public knowledge, we demonstrate empirically that these events were followed by significant price appreciations in the past. More specifically, we expect the price of Bitcoin to reach new all-time highs during 2024 and to break $100,000 by the end of 2024,” analysts at ETC Group affirmed.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

The company’s projection considered various on-chain metrics, such as the dwindling supply of Bitcoin on exchanges and the increase in long-term holdings, which suggest a tightening market that could drive up prices.

“% of exchange supply is at a 5-year low, % of supply last active 1+ years at an all-time high, illiquid supply measure by Glassnode at an all-time high, 3-months + realized cap HODL wave is higher than the last cycle’s top. These on-chain metrics imply that both liquid supply on exchanges is relatively scarce and that there is a lot of ‘dry-powder’ in terms of supply distribution during the next bull cycle,” analysts at ETC Group concluded.

Bitwise’s Estimate: Above $80,000

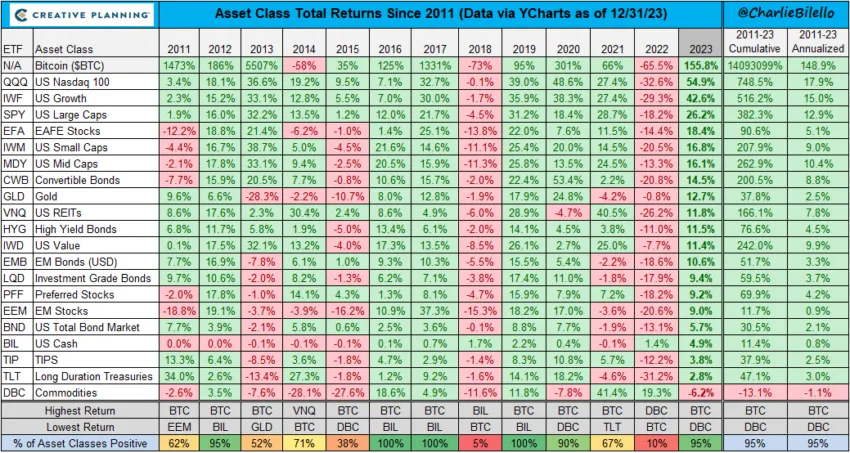

Bitwise, a renowned asset management firm, envisioned Bitcoin surpassing $80,000. Its confidence stemmed from Bitcoin’s stellar performance in 2023, outpacing major asset classes.

“Bitcoin outperformed all major asset classes in 2023, rising 128% while the S&P 500 returned 21%, gold returned 12%, and bonds returned 2%. We expect that trend to continue in 2024, with Bitcoin trading above $80,000 and setting a new all-time high,” analysts at Bitwise wrote.

The firm highlighted two major catalysts for this growth. One is the launch of a spot Bitcoin ETF. And the second one, is the Bitcoin Halving, which is expected to constrict the supply of new BTC while demand continues to rise.

“The launch of a spot Bitcoin ETF (anticipated in early 2024) is expected to usher in a wave of new capital from retail and institutional investors, causing demand for Bitcoin to rise. Meanwhile, the supply of new Bitcoin being produced each year will be cut in half following the next Bitcoin halving in April or May 2024,” analysts at Bitwise stated.

These institutional Bitcoin price predictions vividly depict the potential trajectory in 2024. Despite varying specifics, they collectively underscore a shared optimism about Bitcoin’s future. This bullish outlook is rooted in factors like Bitcoin’s historical dominance, the anticipated increase in adoption following the Bitcoin Halving, and the expected influx of capital from new spot Bitcoin ETFs.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link