Is Bitcoin Going to $40,000 After Higher Than Expected CPI?

[ad_1]

The cryptocurrency market has taken a significant hit, losing over $60 billion in market capitalization following unexpectedly high inflation data in the United States.

This development has considerably cooled the anticipation of an interest rate cut by the Federal Reserve in March, sending ripples across financial markets, including Bitcoin’s valuation.

Bitcoin Drops on Higher Than Expected Inflation

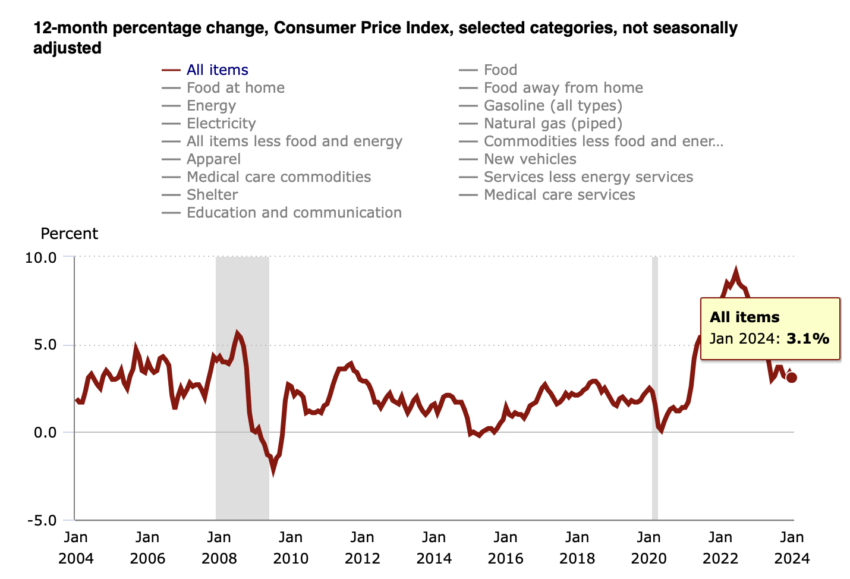

The core Consumer Price Index (CPI) in the US, excluding food and energy costs, rose by 0.4% from December. It marked the largest increase in eight months and exceeded analysts’ forecasts. The CPI saw a 3.9% climb year-over-year, maintaining the previous month’s rate.

This uptick in inflation has quelled the earlier optimism for a Federal Reserve rate cut. And some analysts are now discussing the possibility of resuming rate hikes to ensure broader price stability.

For instance, Kathy Jones, Charles Schwab’s Chief Fixed-Income Strategist, suggested a delay in rate cuts. She also highlighted the role of housing costs in the CPI increase.

“The Fed will view this as another reason to wait until May or June, but the direction of trend is still lower. With much of the increase due to housing, it’s a waiting game to see when those costs will come down,” Jones said.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

The inflation data’s immediate effect was evident in Bitcoin’s price. It saw a more than 3.50% decrease, falling below the significant $50,000 threshold to around $48,300. This downturn reflects broader market sentiment, with the total cryptocurrency market capitalization dropping to $1.78 trillion.

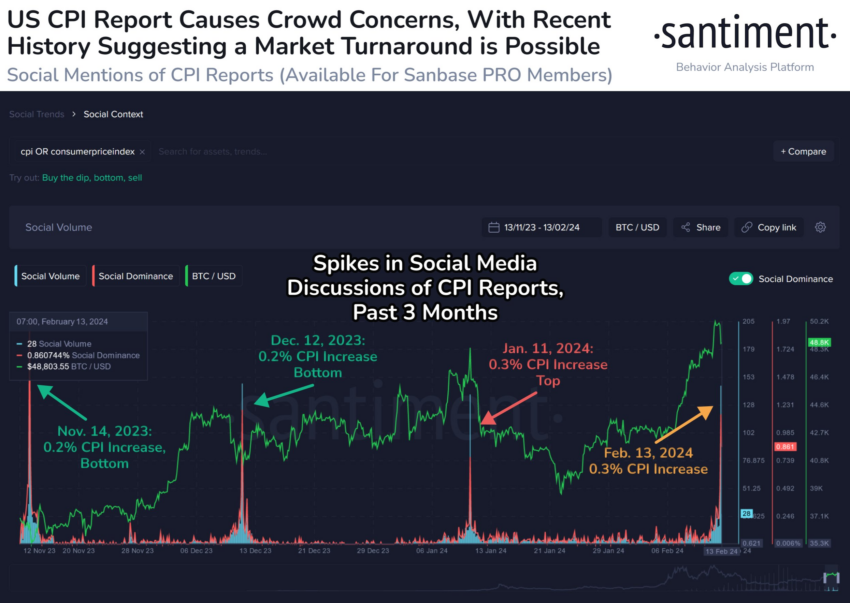

Blockchain analytics firm Santiment offered a perspective on the situation, noting the unexpected CPI outcome and its impact on cryptocurrency and equity markets. The firm highlighted the potential for market volatility and the possibility of a buying opportunity should panic selling ensue, suggesting that previous CPI reports have led to significant mid-term market corrections.

“With Bitcoin falling back below $49,000 today after breaching $50,000 for the first time in over 2 years yesterday, crowd sentiment is likely to become quite polarized with this mild retrace. If there are significant panic sell, dip buy justification becomes significantly more viable while sentiment turns negative,” analysts at Santiment explained.

Despite Santiment’s optimism, a technical analyst known as CryptoCon hinted at a potential correction for Bitcoin to $40,000. He discussed historical price patterns and the 20-week exponential moving average behavior. This analysis suggests a typical cycle pattern for Bitcoin, with the current phase potentially requiring a deep correction.

Read more: Bitcoin Price Prediction 2024/2025/2030

The question remains whether Bitcoin will face a further drop to $40,000 or if the market will stabilize, offering new opportunities to invest. With the next CPI report scheduled for March 12, all eyes will be on how these figures will influence Federal Reserve policies and, in turn, the crypto market and Bitcoin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link