How Bitcoin Can Save the United States: Coinbase CEO Weighs in

[ad_1]

The US national debt soars to unprecedented heights. Amidst this development, Brian Armstrong, the CEO of Coinbase, proposes Bitcoin as a potential lifeboat for the nation’s financial stability.

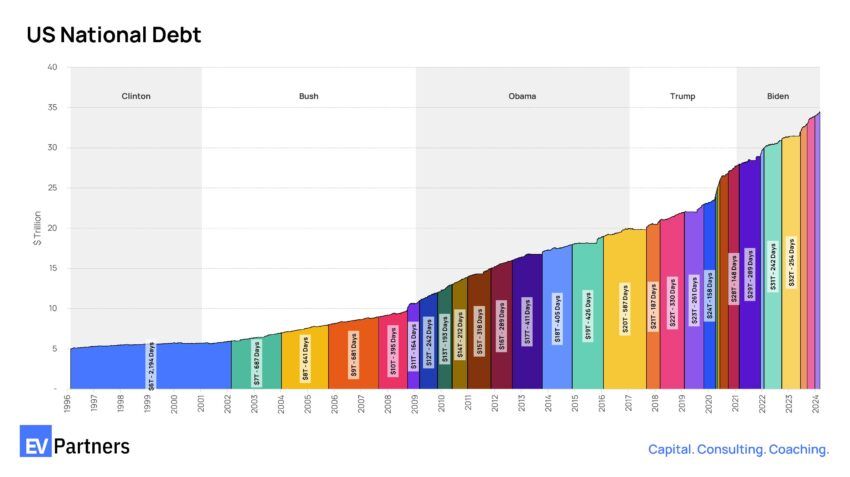

This proposition emerges in response to an eye-opening post by analyst Robert Sterling. It showcases the rapid increase in national debt through a visually striking, color-coded chart.

The US Adds $1 Trillion in Debt Every 3-4 Months

Sterling’s analysis paints a dire picture, revealing a country on the brink of a financial abyss. “This is the scariest chart I’ve ever made,” he states, depicting the relentless climb of the national debt. Notably, it once took six years to add a trillion dollars to this debt; now, that figure is amassed every 90-120 days.

Sterling’s bipartisan critique indeed underlines the role of both major political parties in this alarming escalation.

“The explosion of debt has been the only bipartisan phenomenon of my lifetime. For us conservatives, we can’t blame it on just Biden and Obama. For you Democrats, you can’t put this on just Trump. It’s both parties, all presidents, and every Congress,” Sterling stated.

Furthermore, Sterling traces the debt’s exponential growth back to policies initiated under George W. Bush, exacerbated by the Great Recession and unbridled spending across subsequent administrations. Indeed, this nonpartisan issue has made the national debt spiral out of control.

Read more: Simplifying the Bitcoin Whitepaper: A Comprehensive Guide

Responding to Sterling’s alarming revelations, Armstrong advocates for Bitcoin as a means to voice concern and possibly steer the US towards long-term financial salvation.

“You can buy Bitcoin though as a way to vote with your dollars, send a clear message, and potentially even save the US long term. A return to the gold standard,” Armstrong said.

Armstrong’s view reflects a growing discourse around the sustainability of traditional monetary policies and the search for viable alternatives. Bitcoin’s upcoming halving event, which will reduce the rate at which new coins are created, further highlights its appeal as a deflationary asset amidst rampant fiscal expansion in the US.

As political figures like former President Donald Trump warn of the “ticking time bomb” of unaddressed debt, the conversation around Bitcoin broadly assumes a new urgency. Astonishingly, the US debt rose by $275 billion in a single day in October 2023, pushing the total to a record $33.44 trillion.

This rapid accumulation of debt dwarfs the market capitalization of most crypto assets, signaling a looming crisis.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

In a critique veiled as humor, Elon Musk highlights the precarious state of the US dollar, likening it to a “scam coin” due to its inflationary policies and centralized control. With a fixed supply cap and a decentralized network, Bitcoin starkly contrasts the US dollar’s inflationary pressures.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link