Investors Continue Buying Bitcoin, Latest Fund Flows Report Shows – Here’s Why BTC Could Dominate Institutional Crypto Demand

[ad_1]

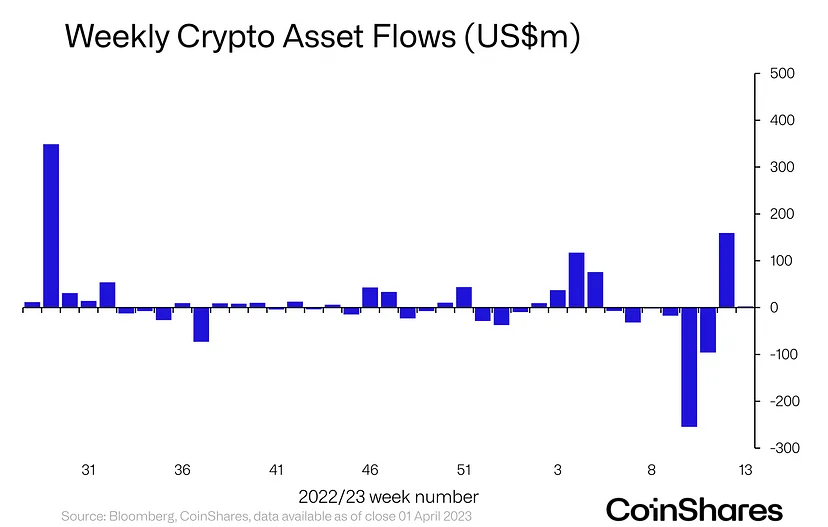

One week after digital asset investment products saw their largest weekly inflow since July 2022 of $160 million, the pace of inflows has all but come to a halt, according to the latest Digital Asset Fund Flows report released on a weekly basis by CoinShares.

According to the crypto data analytics firm, “digital asset investment products saw inflows totaling a lackluster US$2.5m, with trading volumes in investment products falling by 33% compared to the prior week”.

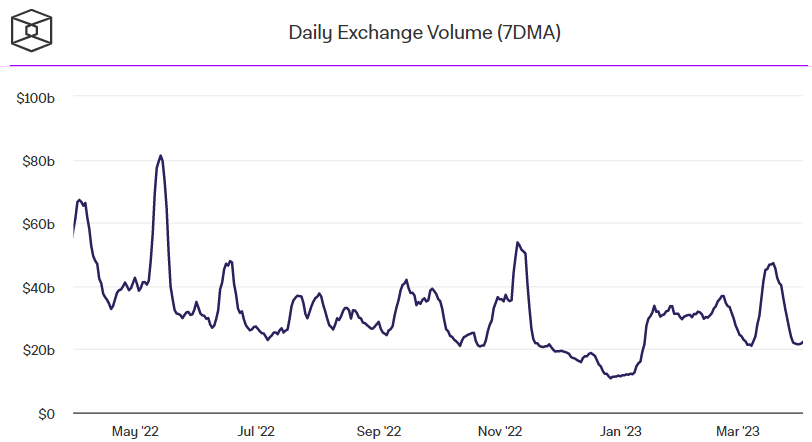

“This was reflected in the broader bitcoin market where trading volumes on trusted exchanges fell by 61%, with both data points suggesting much less participation in the crypto market compared to the prior week,” CoinShares continued.

Indeed, according to data presented by The Block, the seven-day moving average of volumes was around $22.5 billion as of Monday, down from around $46 billion in mid-March.

Lower volumes come at a time when Bitcoin has been going sideways in the $28,000 area now for some time, while other cryptocurrencies have also been subject to rangebound conditions.

Bitcoin Enjoys Decent Inflows

Looking under the hood, sentiment is actually more positive than might be assumed for Bitcoin.

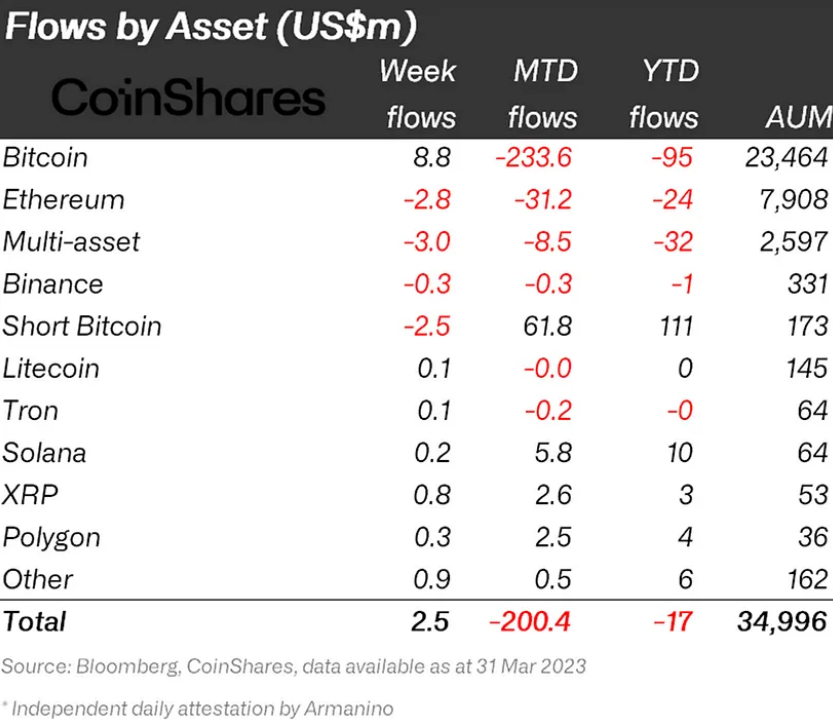

The world’s largest cryptocurrency by market capitalization saw $8.8 million in inflows, while short Bitcoin investment products saw outflows of $2.5 million.

Price appreciation in Bitcoin has left the dollar value of total assets under management “at their highest since the collapse of 3 Arrows Capital in June 2022 at US$23.5bn,” CoinShares noted.

Ethereum and multi-asset products saw a combined outflow of $5.8 million, while smaller coins like Litecoin, Tron, Solana, XRP and Polygon all saw modest small inflows.

According to CoinShares, “inflows into short-Ethereum (US$0.5m) suggest investors remained concerned for the upcoming Shanghai upgrade which will enable un-staking (yield distribution)”.

Data from alternative crypto analytics firm CryptoQuant, which instead refers to on-chain data, shows that the amount of Bitcoin being held by digital asset managers, which can include trusts and exchange-traded products, has been rising in recent weeks in wake of US banking failures in mid-March.

According to CryptoQuant, fund holdings were at 692,000 BTC (worth around $20 billion at current prices) as of Sunday, up from around 688,000 BTC on the 14th of March.

At current levels above $28,000, Bitcoin’s price is up sharply since a brief mid-March dip to sub-$20,000 levels.

Analysts have put the cryptocurrency’s sharp rebound down to 1) safe-haven demand amid concerns about a US (and global) bank crisis and 2) bets that the Fed is nearly done with its tightening cycle and might soon be cutting interest rates, which has been weighing on US bond yields and the US dollar (and boosting crypto in general).

According to CryptoQuant’s data, rising demand from investors in Bitcoin trust and exchange-traded products must have played a role in the price rise.

A greater proportion of Bitcoin moving towards these sorts of investors suggests rising institutional adoption, which has in the past been touted as a major long-term driver of crypto price appreciation.

Here’s Why Bitcoin Could Dominate Institutional Crypto Demand

Bitcoin could disproportionately dominate institutional demand in the next bull market cycle.

That’s not just because Bitcoin, the world’s first, oldest and most secure cryptocurrency (according to many proponents, at least), is viewed as the best bet against a traditional financial system banking crisis by many.

It’s also because Bitcoin is largely in the all-clear when it comes to regulations, whereas many other cryptocurrencies are not.

Take the US Securities and Exchange Commission. The have publicly claimed that Bitcoin is a digital commodity and so not under their regulatory oversight, but that most other cryptocurrencies are securities.

These include crypto networks like Ethereum, which offers yield to stakers of its Ether token, something the SEC likely views as a security.

And its not just staking that puts a cryptocurrency at risk of being deemed a security.

The way it was initially distributed is also a risk, as Ripple found out in 2020 after being sued by the SEC over its distribution of XRP tokens, which the SEC claims was an unregistered securities offering.

Momentum does seem tilted towards Ripple winning this lawsuit right now, however.

Bitcoin seems to be the only cryptocurrency in the all-clear right now (though for the same reasons, there is also a very strong argument that the likes of Litecoin and Dogecoin are also digital commodities).

That means investors might prefer to invest in Bitcoin over some of its major smart-contract-enabled, proof-of-stake powered layer-1 blockchain rivals like Ethereum, Cardano, Solana etc.

[ad_2]

Source link