DeFi Players Prepare for Potential DAI Savings Rate Hike

[ad_1]

The Maker Decentralized Autonomous Organization (MakerDao) has proposed raising interest rates on its DAI stablecoin. Under the proposal, the DAI Savings Rate (DSR) will rise from 1% to 3.3%.

If the proposal passes, its consequences could be felt across the DeFi ecosystem.

What is the DAI Savings Rate?

The Dai Savings Rate (DSR) is a fundamental component of the Maker Protocol. It sets the rate of interest users to earn on their deposited DAI. Interest is accrued in real-time, accumulating from the system’s revenues.

The proposed rate hike was submitted by BlockAnalytica. It is part of a series of bundled-together changes to DAI’s stability-enforcing mechanisms. DAO members will now vote on the proposal.

DAI Returns Could Beat Other Stablecoins

With improved returns for DAI holders, the dollar-pegged stablecoin could soon offer a better return on investment compared to its Decentralized Finance (DeFi) peers. And the results could have a significant impact on the wider DeFi space.

Additionally, if the proposal to raise the DSR to 3.3% is approved, it will surpass the returns offered by Compound and Aave, which currently earn 2.5% and 2% respectively.

And in such a reconfigured DeFi market, investors may choose to reallocate their funds into the Maker protocol.

Implications for DeFi Borrowing

Commenting on the new proposal in a tweet, Block Analitica founder Primoz Kordez said the move would set rates higher across the DeFi landscape. Moreover, he remarked that “DAI in DSR is the benchmark for [the] safest DeFi stablecoin yield.”

In turn, he pointed out that this would drive up the cost of DeFi borrowing.

That would affect the cost of borrowing from MakerDAO’s own lending product Spark, which launched earlier this month. Under the 1% DSR, Spark allows users to borrow DAI with a 1.1% interest rate. And as Kordez observed, a 3.3% DSR could see the cost of borrowing DAI rise to around 4.5%.

Following The Fed

MakerDAO’s proposal to raise the DSR follows a series of rate hikes imposed by the U.S. Federal Reserve. The Fed’s own base interest rate currently stands at 5.25%.

While higher federal interest rates lead to greater yields on dollars deposited in banks, the improved returns on fiat cash don’t appear to have deterred people from holding stablecoins.

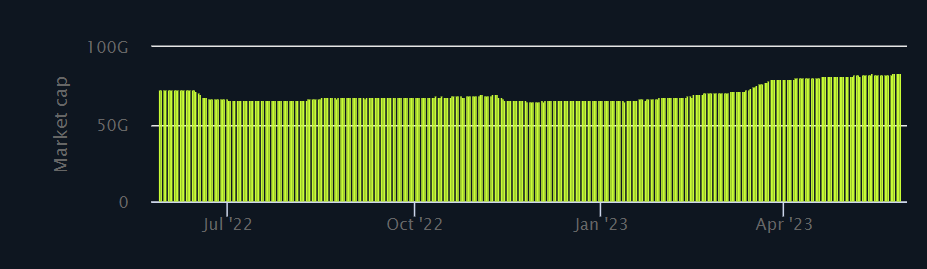

For example, Tether’s USDT issuance has increased in recent months. And there is now over $83 billion worth of USDT in circulation. This reveals a healthy appetite for digital dollars that don’t reside with U.S. banks.

And because Tether doesn’t pay out interest directly to holders, the company has been able to leverage returns it made from U.S. Treasury Bills to buy an additional 1.5 billion USD worth of Bitcoin.

Moreover, the price of Bitcoin has generally responded positively to Fed rate hikes.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link