Central Banks Are Buying Gold Over Bitcoin as a Safe Haven Asset

[ad_1]

Central banks around the world have been loading up on gold in an effort to stay ahead of inflation, according to recent research. People have long considered gold as a store of value and inflation hedge, but Bitcoin has vastly outperformed it this year.

According to a recently published report by American independent investment management company Invesco, central banks are buying gold.

Central Banks Loading Up on Gold

The 2023 Invesco Global Sovereign Asset Management Study released in July revealed that 85 sovereign wealth funds and 57 central banks are collectively managing $21 trillion.

“Amid persistent high inflation and real interest rates, investors are recalibrating portfolios,” it stated.

Coinbase former chief technology officer, Balaji Srinivasan, commented on the research summarizing:

“In summary, they’re buying gold, holding it in vaults, and preparing for high levels of inflation.”

Invesco reported that in 2022, central banks made record gold purchases with net acquisitions of 1,136 tonnes. The year was the twelfth consecutive year of a net increase in gold holdings for the world’s central banks.

Furthermore, the central banks of China and Turkey were very aggressive buyers snapping up 20% of that total. “However, other central banks, particularly in the Middle East and Emerging Markets, were also noteworthy buyers,” it added.

The report added that portfolio managers identified inflation as a key risk. Around two-thirds of central banks were seeking to protect their portfolios from global inflationary trends, it noted.

“Increasing gold allocation was the most prevalent method, with 69% of central banks countering global inflation through gold allocations.”

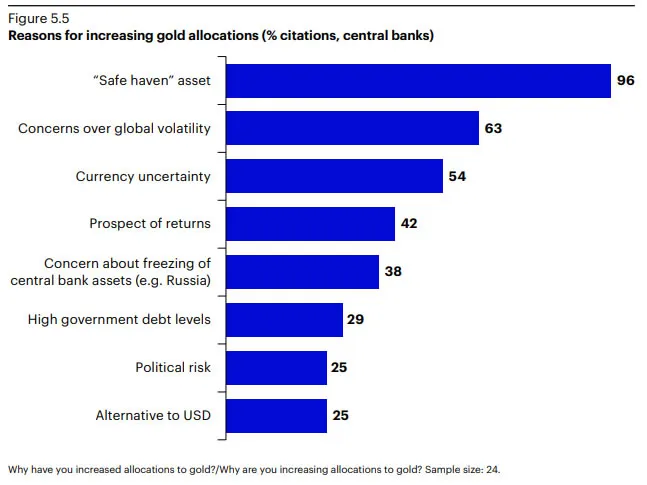

Central banks were unanimous in their reasons for loading up on gold, stating that it was a safe haven asset.

Furthermore, a substantial percentage of central banks express concern about the precedent that U.S. sanctions set. This makes gold even more attractive, they noted.

Additionally, physical gold bullion is more attractive than exchange-traded products such as futures.

Gold vs. Bitcoin

Srinivasan said that the “reserve role is being taken up by hard assets like gold and Bitcoin, as even BlackRock now admits. Trade roles are taken up by currencies such as the Chinese yuan and Indian rupee as central banks de-dollarize, he said.

Central banks are still very wary of digital assets. But there is no doubt that Bitcoin has vastly outperformed gold recently.

Since the beginning of the year, BTC prices have gained more than 80%. Gold prices, on the other hand, have only managed 4.6% over the same period.

Stablecoin issuer Tether has also recently touted its gold-backed asset XAUT as a hedge against inflation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link