Long Liquidations Spike Bitcoin Suffers “Sell the Fact” Reaction to Dovish Fed, But BTC Dip-Buyers Will Probably Pounce

[ad_1]

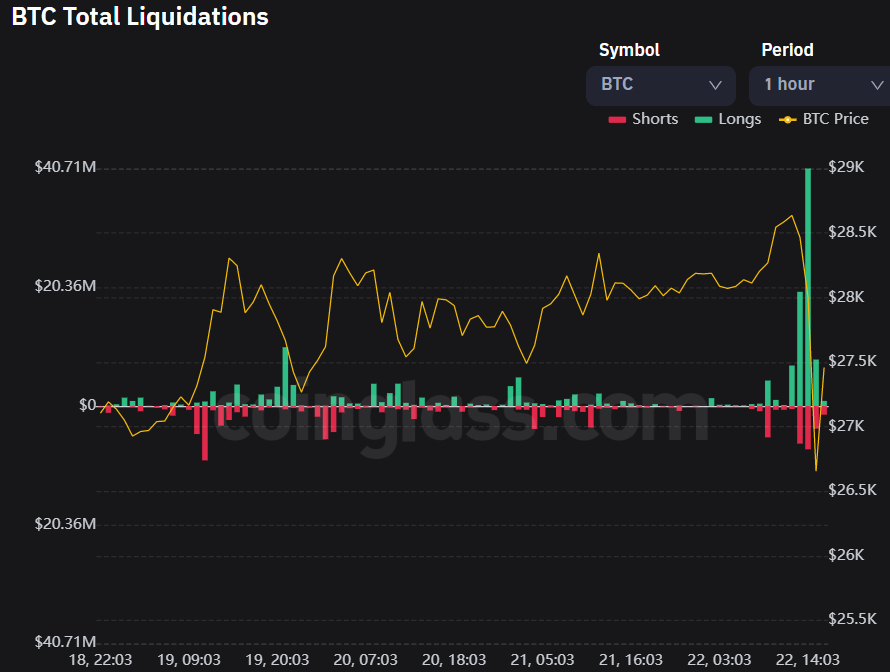

Despite the fact that most market participants interpreted the latest Fed policy announcement as more dovish than expected, hence the drop in the US dollar and US yields, Bitcoin markets saw a “sell the fact” reaction, with the BTC price pulling back sharply and long liquidations spiking.

BTC/USD was last changing hands in the mid-$27,000s, having at one point been as low as the $26,600s, down around 2.2% over the last 24 hours as per CoinGecko.

According to crypto derivatives analytics website coinglass.com, around $60.2 million in Bitcoin futures long positions were liquidated in the first two hours after the Fed’s policy announcement.

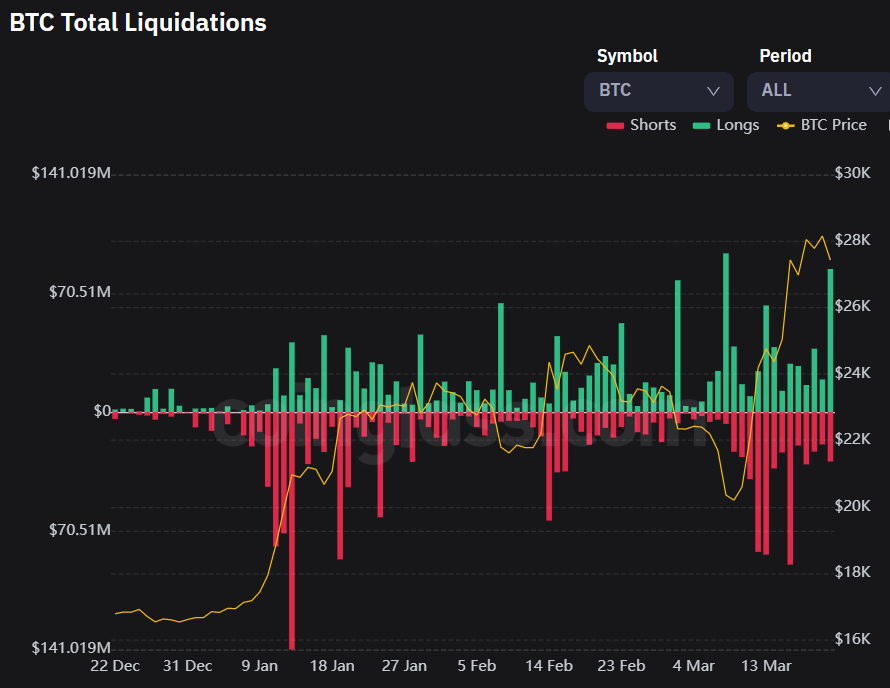

Long liquidations for the day were last around $85 million, their highest level since the 8th of March.

Fed Presses Ahead With Rate Hike, But Comes Across as Dovish

The Fed lifted its benchmark interest rate range by 25 bps to 4.75-5.0% as expected, but softened its language on the prospect of further hikes after acknowledging that recent US bank troubles added downside risk to the economic outlook.

Where it had before said “ongoing increases” “will” be appropriate, it now says “some” additional policy firming “may be appropriate”.

The Fed left its quantitative tightening schedule, which allows $95 billion in maturing assets to roll of its balance sheet every month, unchanged, whilst noting that inflationary pressures remain elevated, an unsurprising acknowledgment in wake of recent upside inflation and jobs data surprises.

Finally, the median prediction from the Fed’s new dot plot showed the central bank sees interest rates ending the year at 5.1%, unchanged from the December dot plots and lower than consensus market expectations for 5.4%.

This, combined with the Fed’s shift in language, seemed to be enough to spur a dovish reaction in currency and bond markets. The US Dollar Index (DXY) was last down around 0.6% near 102.50, while the US 2-year yield fell 23 bps back under 4.0%.

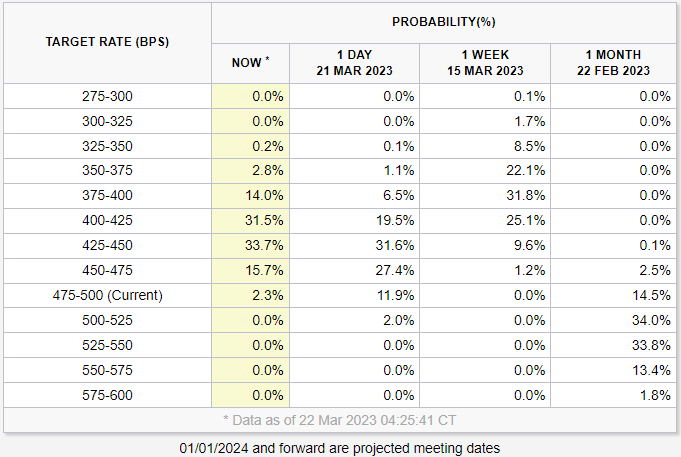

US money markets saw a dovish shift in their pricing of where US interest rates are likely to be headed this year.

As per the CME’s Fed Watch Tool, the likelihood of the Fed having embarked on between 50-75 bps of rate hikes by the end of 2023 is now priced at around 65% versus around 50% one day ago.

Bitcoin Bulls Likely to Buy the Dip, $30,000 in Sight?

Prior to the Fed meeting, the Bitcoin price had been on the front foot, hitting new nine-month highs in the $28,900s earlier in the session.

With the Fed meeting out of the way, a large number of traders appeared to want to take profit, leading to what some labeled a “sell the fact” reaction to the dovish meeting.

Of course, downside in US equity markets on Wednesday could also have weighed on crypto, despite the correlation between the two asset classes having weakened substantially as of late.

The drop in stocks was led by downside in bank names after US Treasury Secretary Janet Yellen commented that the government isn’t considering extending deposit insurance from the current $250,000 per account to cover all deposits.

This comment may spark some fears amongst bank customers that their deposits (above $250,000) aren’t safe, raising the risk of a bank run, which could explain the downside in bank stocks.

But Wednesday’s resurgence of US bank stability fears is likely to attract Bitcoin dip buyers.

Indeed, since the collapse of three US banks earlier this month, Bitcoin has been acting as a safe haven against instability in the traditional financial sector.

If downside in US bank stock names continues, it may not be long until BTC hits $30,000, or even the next major resistance area around $32,500-$33,000.

Given Bitcoin’s traditional negative correlation to the US dollar and US yields, downside in both of these traditional assets also favors a potential recovery in the Bitcoin price to fresh multi-month highs.

[ad_2]

Source link