SoftBank Boosts AI Investment ‘Offense’ After Shift From Crypto

[ad_1]

SoftBank, the Japanese tech investment colossus, is reportedly increasing its multi-billion dollar investments in artificial intelligence (AI) following the successful listing of its Arm unit.

CEO Masayoshi Son is keen on investing tens of billions of dollars in AI and has expressed interest in a strategic partnership with OpenAI, the maker of AI-powered chatbot ChatGPT.

Softbank Going All Out on AI Bets

This move comes amid SoftBank’s strategic shift from “defense mode” to “offense mode,” a decision prompted by the excitement surrounding advances in AI.

Son, a self-proclaimed “heavy user” of ChatGPT, has been in regular contact with OpenAI CEO Sam Altman. The potential strategic partnership with OpenAI is not the only AI venture on SoftBank’s radar. The company has also shown preliminary interest in Graphcore, a UK-based AI chipmaker. However, Graphcore has denied any offers from SoftBank to buy the company.

Read more: ChatGPT Tutorial: How To Use ChatGPT by OpenAI

Son is adamant that,

“AI is the biggest revolution in human history. I believe human revolution equals to AI, and we are now facing such a big revolution. I believe AI will change or will redefine all these industries; that’s how I interpret this era. So, I say the winners in AI will be winners in the future.”

SoftBank’s increased focus on AI investments comes after a successful IPO of its Arm unit, which secured a valuation of $54.5 billion, a significant increase from the $32 billion SoftBank paid to take the company private seven years ago.

In addition to OpenAI, SoftBank is also reportedly partnering with robotic warehouse company Symbotic. The pair hopes to establish a joint venture, GreenBox Systems LLC. The venture, worth $100 million, aims to build AI-powered warehouses.

Breaking Up With Crypto

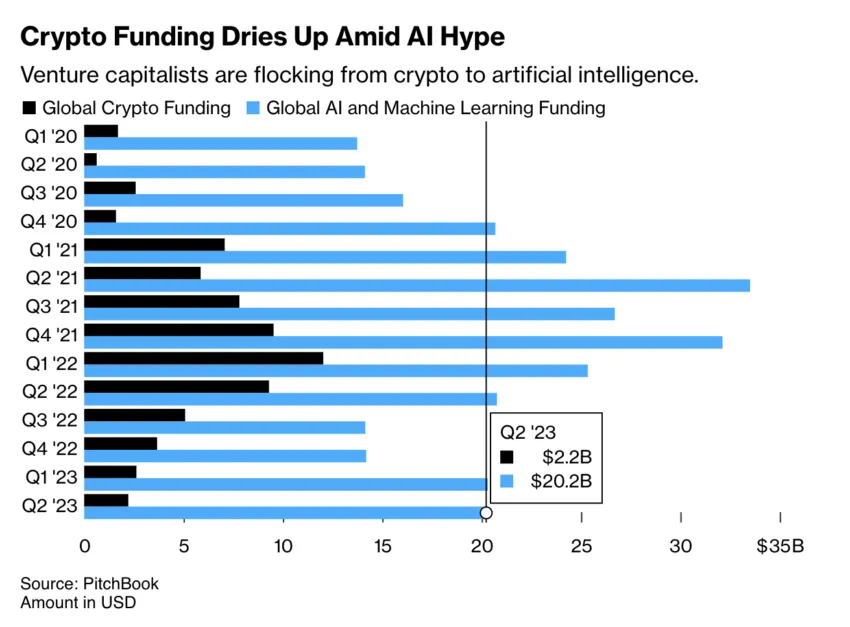

While SoftBank is ramping up its investments in AI, it’s easing off investments in blockchain and cryptocurrency. The company has reportedly decided to step away from volatile crypto companies, especially after a painful year for the industry.

SoftBank’s Vision Fund 2 is home to most of the company’s crypto and blockchain portfolio companies. It has lost $16.7 billion since its inception in June 2019 on $49.9 billion invested, according to a February report. The company has lost $34.5 billion across its Vision Funds since the start of its fiscal year in April.

As AI continues to attract investors, SoftBank’s strategic shift from blockchain to AI underscores the firm’s commitment to stay ahead with its tech investments.

The company’s decision to invest heavily in AI, particularly through potential partnerships with OpenAI and other AI ventures, is a testament to its belief in the transformative potential of AI technologies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.

[ad_2]

Source link